At Claremont Management, we can help you decide which choice is best for you.

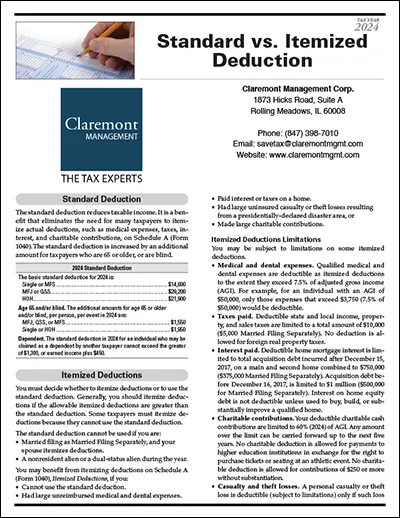

The standard deduction is a benefit that reduces taxable income. It eliminates the need for many taxpayers to itemize actual deductions, such as medical expenses, taxes, interest, and charitable contributions, on Schedule A (Form 1040). The amount of the standard deduction varies depending on your filing status and is increased by an additional amount for taxpayers who are 65 or older, or are blind.

The standard deduction is a benefit that reduces taxable income. It eliminates the need for many taxpayers to itemize actual deductions, such as medical expenses, taxes, interest, and charitable contributions, on Schedule A (Form 1040). The amount of the standard deduction varies depending on your filing status and is increased by an additional amount for taxpayers who are 65 or older, or are blind.

One of the most common questions people have is whether they should take the standard deduction or itemize their deductions. As a general rule, you should itemize deductions if the allowable itemized deductions are greater than you would receive with the standard deduction.

However, there are exceptions to this rule, as well as cases where you may not be eligible to take the standard deduction. For example, let's say you're married and each of you are filing separately. If your spouse itemizes his/her deductions, then you must do the same on your return; you are not eligible to take the standard deduction. In addition, if you are a non-resident alien or a dual-status alien during the tax year, then you must also itemize your deductions.

If you would like to learn more about the amount of the 2024 Standard Deduction by filing status, which expenses are deductible and which are not, and more, we've put together this informative PDF handout you can download below.

File size: Approx. 350 KB

Secure Client Login

Secure Client Login