With the rise of tax return-related identity theft, we strongly urge all of our clients to take advantage of the IRS Identity Protection PIN program.

CNBC recently reported, “The IRS flagged more than 1 million tax returns for potential identity theft during the 2023 tax season, according to the U.S. Department of the Treasury, signaling that such fraud continues to be a pervasive problem for taxpayers.”

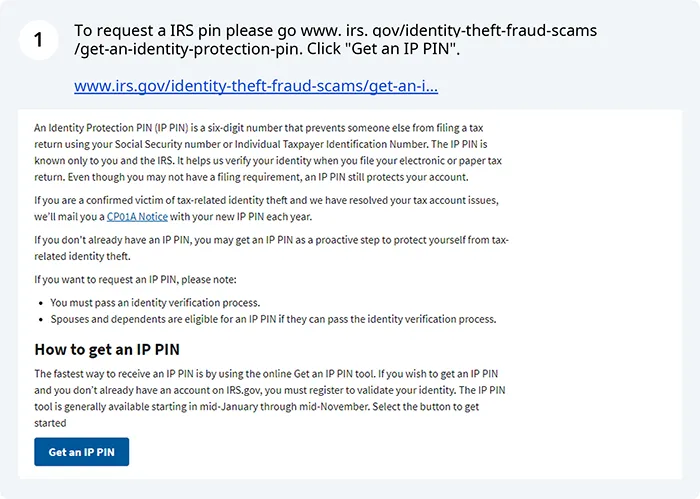

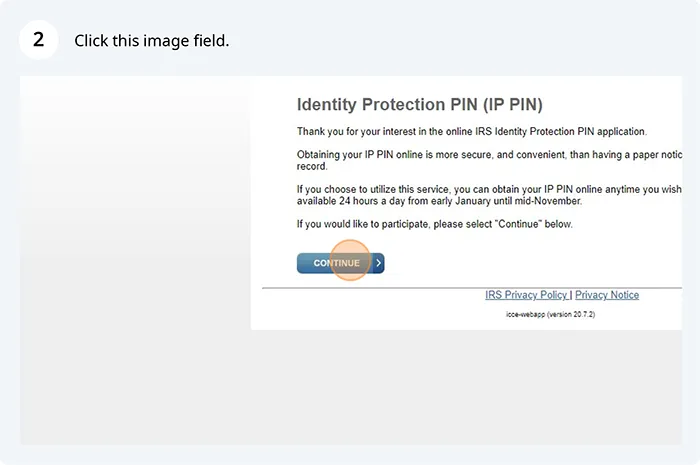

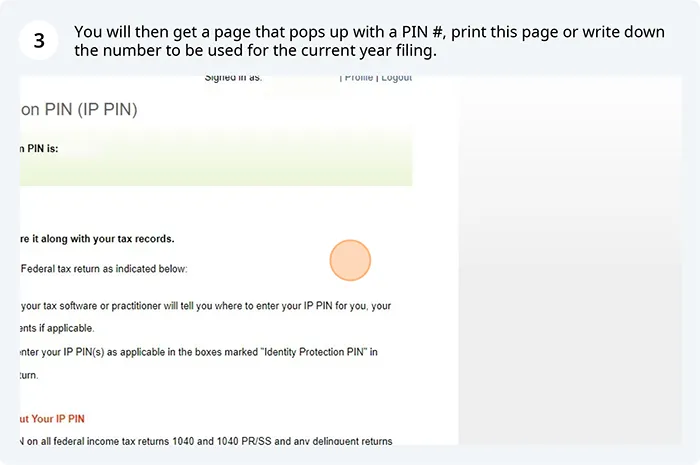

Fortunately, there is something you can do about it, which is why we put together this simple, step-by-step guide on how to request an Identity Protection (IP) PIN from the IRS through their website (at IRS.gov). This process helps the IRS ensure that a fraudster cannot file a false tax return in your name.

If you already have an account on the IRS website, getting your PIN only takes a few clicks.

Download our free guide:

File size: Approx. Approx. 6939 KB

Secure Client Login

Secure Client Login