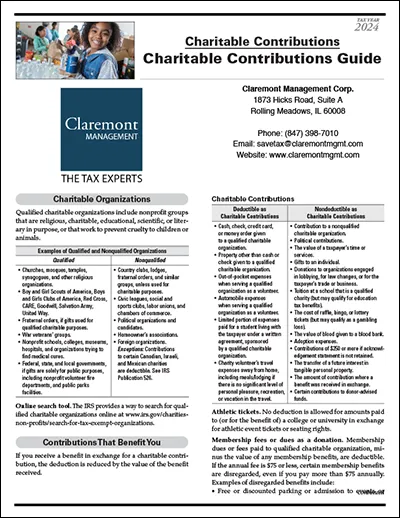

Download Claremont Management's informative guide on tax deductions for charitable contributions.

This handy PDF publication covers a range of important considerations and offers examples of qualified and nonqualified organizations, as well as deductible and nondeductible contributions. It also talks about charitable contribution deduction limitations and explains how vehicle donations work, the importance of obtaining a written acknowledgement, deduction limits and other factors, and more.

We always like to make things easy for our clients, so here are a few simple steps you can take to keep track of charitable contributions:

- Whenever you donate, ALWAYS ask for a receipt.

- Take a picture or scan the receipt so you have a digital copy of it saved.

- Keep a log if you make several donations throughout the year.

File size: Approx. 474 KB

Secure Client Login

Secure Client Login